The difference between American and foreign prices grew 4 percent from May 11 to June 11, and by 114 percent since tariff threats began in February, according to the latest installment of Business Forward’s Steel Index.

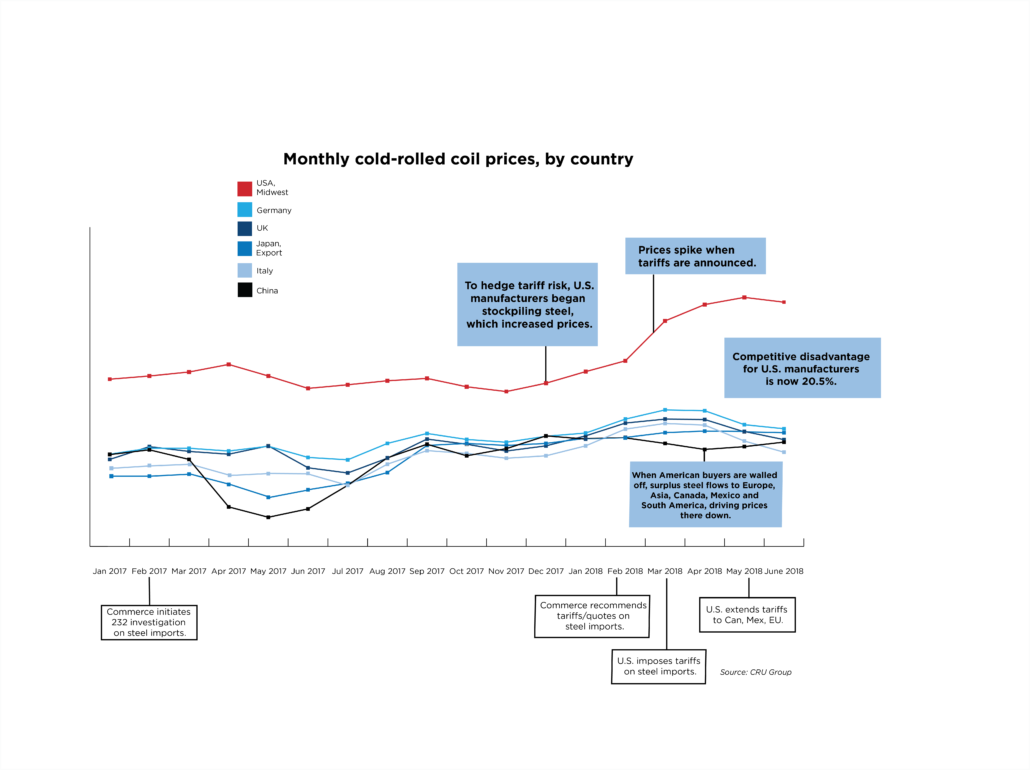

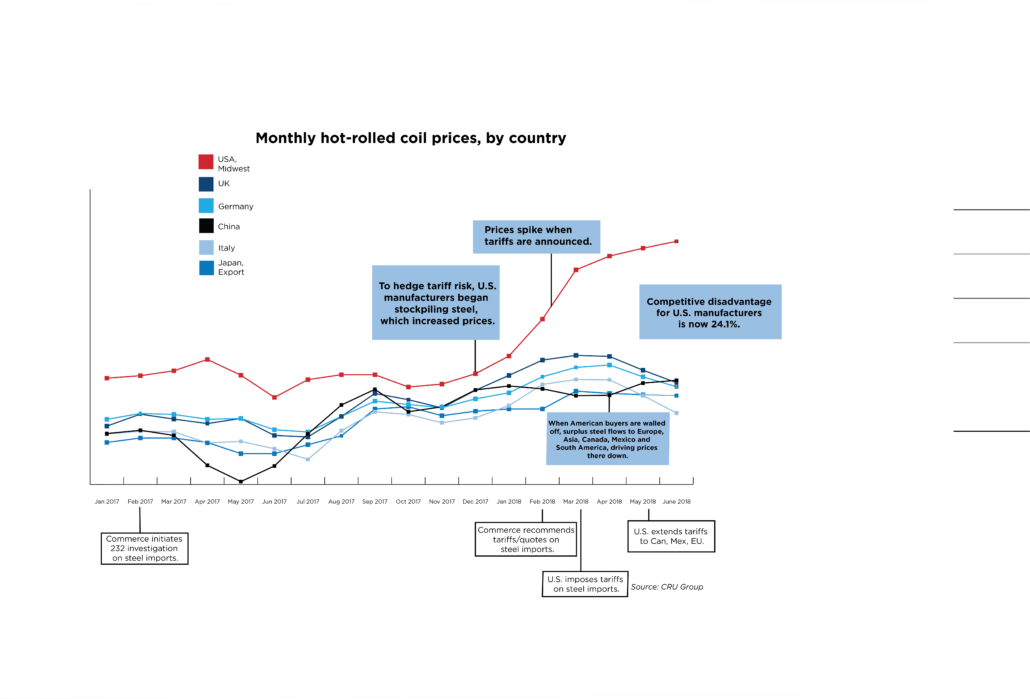

The monthly report compares the prices American manufacturers and their foreign competitors pay for hot- and cold-rolled steel. Key charts are below. Click here to read the report.

Steel prices here in the U.S. began rising when Trump started talking about tariffs eleven months ago, and they took off last quarter when he announced them. Since February, U.S. steel prices have increased 19 percent, on average. (Hot-rolled steel prices are up 21.5 percent; cold-rolled steel prices are up 17 percent.)

If steel represented 20 percent of a business’s cost of production in February and their profit margin was 10 percent, these price increases wiped out more than a third of the company’s profit. They are left absorbing the loss, raising prices, or laying-off employees.

Rising prices are particularly hard on manufacturers that export, but price increases in the U.S. are just half the story. Tariffs here cause surplus steel to flow to Europe, Asia, Canada, and Mexico, which drives their prices down.

Prices in the UK, Italy, China, Germany and Japan dropped 3 percent since February, on average. (Hot-rolled steel prices fell by 2.6 percent; cold-rolled steel prices fell 3.5 percent.)

This past month, U.S. manufacturers’ price disadvantage on steel grew to 22.2 percent, on average. (American manufacturers pay 24.1 percent more for hot-rolled steel and 20.5 percent more for cold-rolled steel.) The difference between prices here and in those markets has more than doubled since February (114 percent). See the charts below.