Introduction

Over the past two years, Business Forward has organized dozens of energy and climate briefings for business leaders across the country. At these briefings, policymakers met with executives from energy companies. In each case, the discussion focused on four key questions:

- Can wind and solar compete with coal and natural gas on price, at scale?

- Is it reliable?

- Are government subsidies distorting the market?

- Is America still leading on energy?

Testimonies from energy executives at those briefings confirm the latest research:

- Recent investment has generated a “virtuous cycle” that is driving costs down and creating new demand – and technological breakthroughs are accelerating this cycle.

- As businesses rely more on renewable energy, the challenge of “balancing” energy production grows, but improvements to the grid, better energy management, and new storage solutions are promising.

- Recent investments in solar, wind and other new energy technologies are in line with historic investments in other promising, high risk alternatives, like nuclear power, deep water oil rigs, and clean coal.

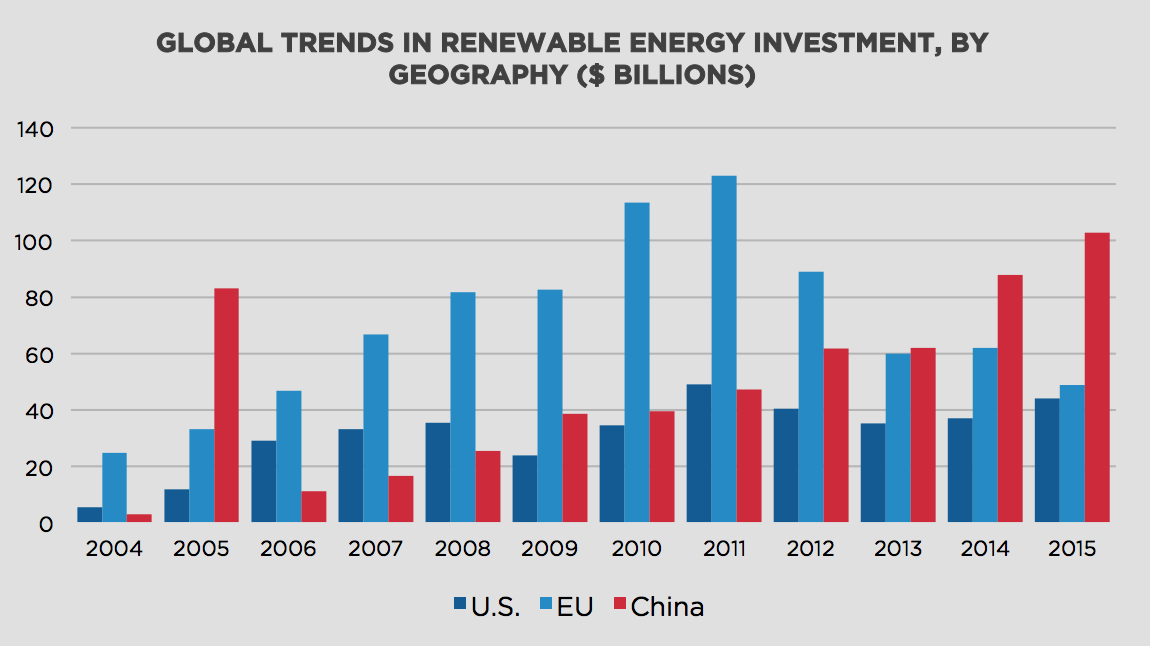

- The United States maintains its lead in early stage investing, but we are substantially behind the EU and China on R&D and investment.

We encourage incoming officials at the U.S. Environmental Protection Agency and U.S. Department of Energy to consider these findings as they plan for the next Congress.

Can Renewable Energy Compete?

Record investment has created a “virtuous cycle” that is reshaping our energy economy: falling prices for wind and solar are driving more demand, which attracts more investment, which drives prices down further, which creates even more demand, and so on.

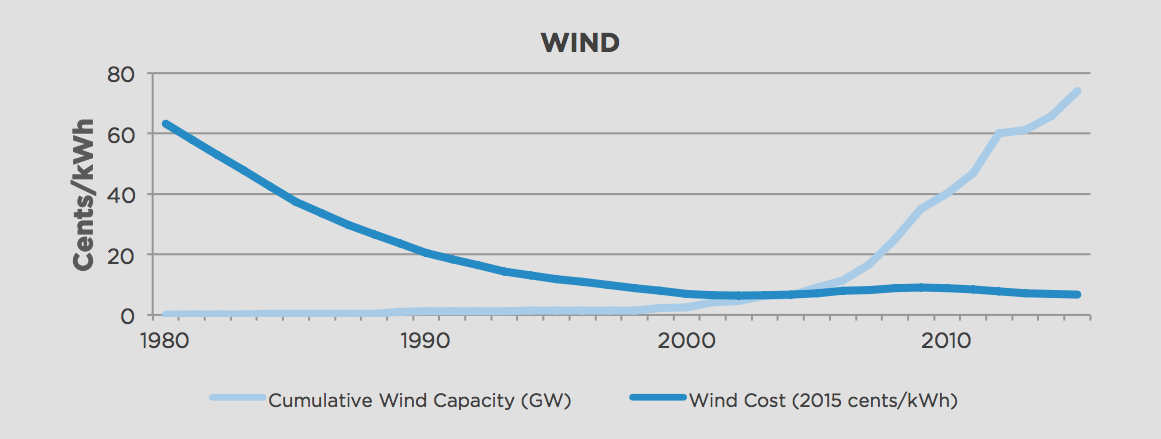

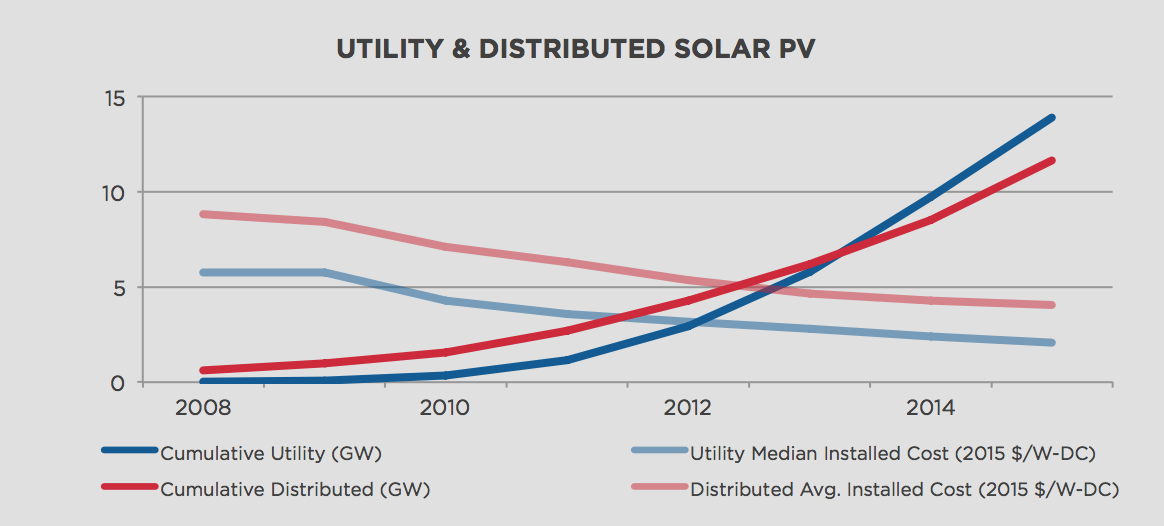

- CAPACITY. Over the last seven years, wind power capacity more than tripled, and solar power capacity increased 30-fold.

- COSTS. During that same period, the cost of wind power fell by 41 percent, utility solar installation prices fell by 64 percent, and consumer solar prices fell 54 percent. Industry experts predict those costs could drop another 35 percent by 2050.

- INVESTMENT. In 2015, wind and solar accounted for 66 percent of new capacity installed in the U.S.

Industry experts estimate that wind power could meet 20 percent of America’s electricity needs by 2030 and 35 percent by 2050, while solar panels on homes and businesses could provide as much as 39 percent of America’s electricity needs, if deployed universally.

Is it Reliable?

Solar and wind power output varies with the season, time of day, and weather. In theory, a 100MW per year offshore wind farm could generate that amount of power running at full speed, 24 hours a day, 365 days a year. In practice, that wind farm currently generates between 20MW and 35MW per year. Improvements to the grid, better forecasting and energy management, and new storage solutions are making it easier to “balance” renewable energy.

Utilities have four means of balancing the grid, and each is improving rapidly:

- Add conventional generation capacity that can be turned on quickly to cover short-term gaps. Utilities are developing conventional coal- and gas-powered turbines that can be turned off and on more rapidly. Hydro-electric stations can replenish their reservoirs when solar and wind power are near capacity, then release water to generate electricity when solar and wind power capacity wanes.

- Use grid “interconnectors” to pipe electricity from locations with surplus power to those with shortfalls, in real-time. More than $10 billion in improvements to the grid have been made in the past eight years.

- Manage demand by varying electricity pricing to encourage big users to reduce consumption during peak times. New energy management information systems are helping companies capture these savings, while smart meter-driven big data analytics are allowing utilities to calibrate incentives more efficiently.

- Use batteries and other solutions to store surplus wind and solar energy so that it can be used later. Today, battery storage adds about 25 percent to project costs, but battery costs are falling. Other solutions include using surplus energy to compress air, then release this air to power turbines when demand requires it.

Are Government Subsidies Distorting the Market?

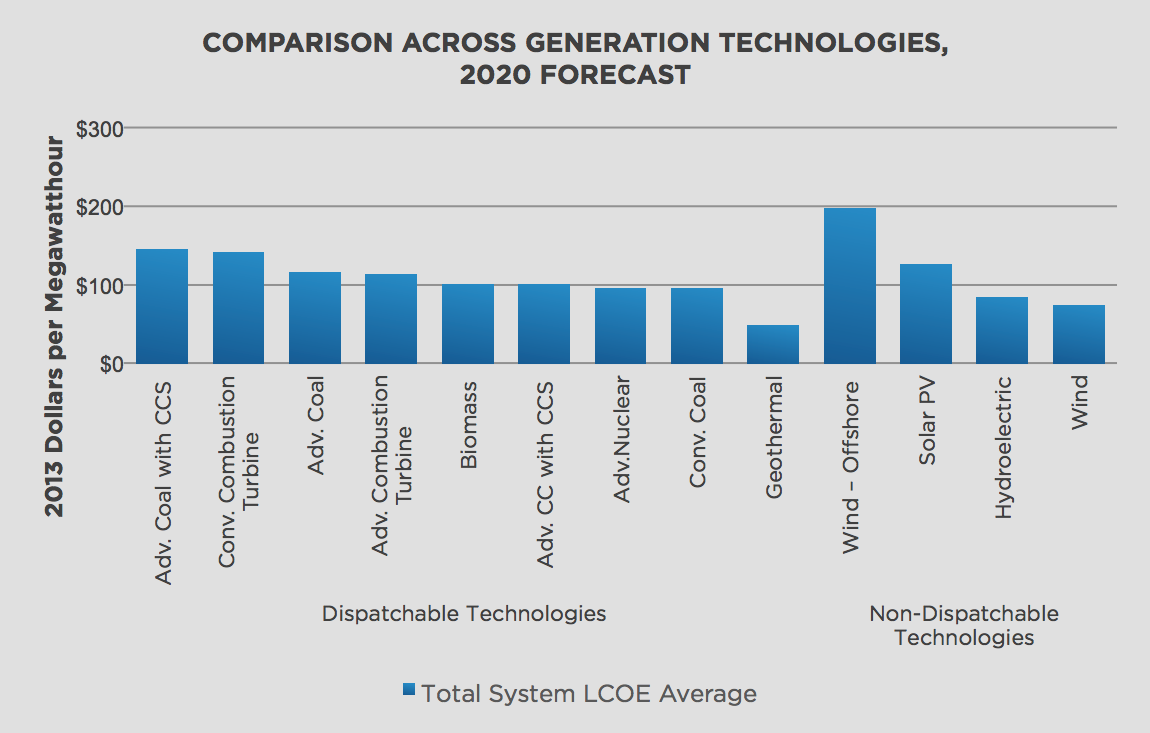

Renewable energy is approaching cost parity with coal and gas – and could reach parity in most markets by 2020. When environmental costs are included, the difference shrinks further.

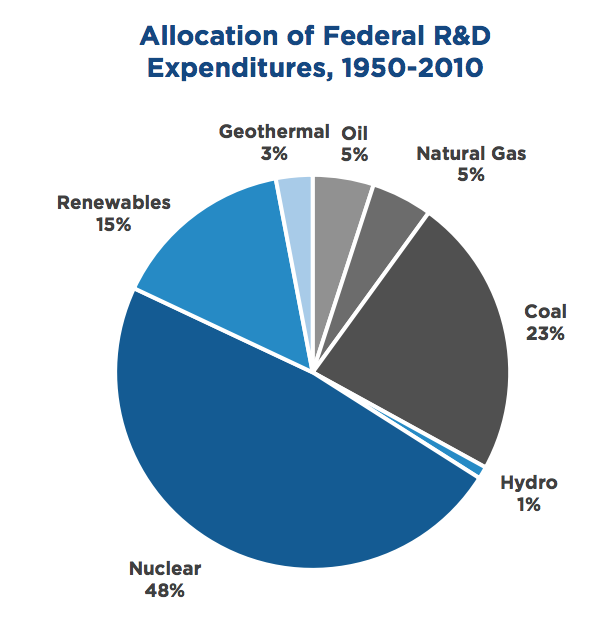

Since World War II, the federal government has spent nearly $1 trillion on tax incentives, grants, loans, regulations, and R&D to ensure America’s energy security and offset the cost of that energy to consumers. Seventy percent of that support went to coal, gas, and oil.

This reflects new concerns over climate change, but it also is consistent with the U.S. government’s history of investing in promising, but risky, new energy technologies. Today’s tax incentives for wind and solar power resemble earlier investments in nuclear energy, deep water oil rigs, and clean coal.

Are We Still Leading?

In the United States, investment increased 19 percent to $44.1 billion. However, the U.S. ranks third behind China and the EU in renewable energy investments. In fact, last year, China invested more than twice as much as the United States ($102.9 billion vs. $44.1 billion).

The United States leads the world in R&D (based largely on our private sector,) but it ranks third behind the EU and China in renewable energy R&D.